Revised Concessional Contributions

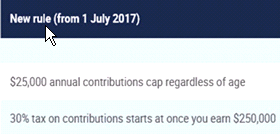

With the commencement of the new Tax Year it is important to check your likely Concessional Superannuation Contributions for the coming year against the new contributions cap of $25,000 (regardless of age).

Previously this was either $35,000 or $30,000 depending on your age.

The cap applies to all concessional superannuation contributions received by all of the member’s superannuation funds during a tax year. The cap applies per individual and not per fund.

Changes to the annual concessional contributions cap, and the income threshold at which a 30% tax rate will be applied to your concessional contributions follow:

Concessional contributions include:

- Employees

- Employer Superannuation Guarantee Payments (9.5% of salary);

- Employers are statutorily only required to make SG contributions up to the equivalent of $211,040 pa of qualifying earnings (salary, bonus, commissions etc).

- Few employers pay SG above this maximum but earnings of $263,157 per annum would equate to SG contributions equivalent to the concessional contributions cap.

- Salary sacrifice contributions;

- Personal deductible super contributions – this is a new category – refer below for further info;

- Contributions to superannuation in respect of superannuation-owned insurance policies:

- This includes Group Insurance Plans within a superannuation environment – where the employer pays insurance premiums for superannuation-owned policies on your behalf.

- Employer Superannuation Guarantee Payments (9.5% of salary);

We suggest you confirm your current SG payments, salary sacrifice arrangements and superannuation-owned group insurance premiums with your employer, and consider whether you are making contributions to an insurance-only superannuation fund in connection with superannuation-owned insurance policies.

It is also important to consider any bonuses or other lump sum entitlements you become entitled to upon which SG will be payable.

- Self-employed individuals and “Unsupported” individuals

- Personal deductible super contributions – this is a new category – refer below for further info;

- Contributions to superannuation in respect of superannuation-owned insurance policies.

Personal deductible contributions

The removal of the ‘10% test’ now enables you to make personal deductible super contributions (PDCs) regardless of your employment status.

New opportunities

This change has enabled certain people to make PDCs where it was previously not possible.

Key examples include where:

- An employer does not offer salary sacrifice.

- People switch from being self-employed to employed during the course of the year. Under the old rules, it is likely they would have failed the 10% test due to their employment income.

- Residents for tax purposes are working overseas for a foreign employer and their employer can’t or won’t contribute to an Australian super fund.

- You receive bonuses or redundancy payments and wish to make concessional contributions but there is no existing salary sacrifice arrangement in place to enable you to do so.

Additional options

For those of you already making sacrifice contributions, you now have some additional options. You can:

- continue with your salary sacrifice

- switch to making PDCs, or

- opt for a combination of both.

The best approach will depend on a range of factors. Key issues to consider include:

Whether salary sacrificing reduces other benefits such as leave loading, holiday pay and SG contributions. Where it does, it may be preferable to maximise SG and other benefits by making PDCs rather than salary sacrificing to super.

Whether you are able to contribute under a current and valid salary sacrifice arrangement, as entitlements already declared and earned cannot be salary sacrificed.When making PDCs, the entire contribution can be made and the deduction amount determined at the end of the financial year when your cash flow and tax position is clearer.

Please review your salary sacrifice contributions and the arrangements you have made with your employer to ensure you do not exceed the reduced concessional contributions cap in 2017/18.