The last week has seen the return of volatility. The Dow Jones Index (DJIA) is down 8.5%, the S&P 500 down 7.8%, and the Australian S&P ASX 300 index down 4.3% – all since their recent highs.

The Dow Jones represents the 30 largest listed companies on the New York Stock Exchange and the NASDAQ, whereas the S&P 500 represents the 500 largest companies listed on these exchanges. This is an important difference – as much of the run up in share values has been in the giant tech stocks such as Apple, Alphabet and Facebook.

The news media is making hay in order to sell newspapers and advertising – declaring in headlines that the Dow Jones had ‘the largest points drop in history!’. Well, that’s pretty obvious when the DJIA index is in the 20,000’s – as opposed to the 10,000s in the early 21st century – and between 200 and 400 in the late 1920’s.

That’s not to say that a 4.5% drop in a day is a minor move. It is material, and overall some markets are in ‘correction’ territory – defined as a decline in excess of 10% from the high.

Fortunately, Fixed Income Securities improved and the Australian Dollar weakened by 2.8% – limiting the declines in an unhedged US equity Investment portfolio – doing exactly what one might expect of a diversified portfolio.

We can provide you with an assessment as to WHY this has occurred, and we are certainly alive to the factors at play. However, none of this gives us any definitive insight into WHAT might happen over the next day, month or year.

How to respond?

When markets are volatile it is natural to feel anxious. Your sense of apprehension can be fuelled by dramatic-sounding news headlines and dated TV file footage of traders waving their hands around. Acting on those emotions, though, can end up doing you more harm than good.

There are always several tidy-sounding theories in the media about what is driving a particular bout of volatility. It can be nervous anticipation of a central bank announcement signalling an increase in interest rates, a geopolitical event like a terrorist attack, or unexpectedly weak economic data.

For individual investors, there can be a natural inclination to want to “do something” in response to volatility. The reality, however, is that making decisions about your own finances based on daily market movements is almost always counter-productive.

Increasing market volatility is essentially an expression of uncertainty. Markets move on new information which is incorporated into prices immediately. Those prices reflect the aggregate views of millions of participants, so unless you have information that no-one else is privy to, you are unlikely to get an edge by trying to time your entry and exit points.

As to what happens next, no-one knows for sure. That is the nature of risk. Investors in the meantime can protect themselves during volatility by diversifying broadly across and within asset classes.

For those still anxious, here are seven simple truths to help you live with volatility:

1. Don’t make presumptions.

Remember that markets are unpredictable and often do not react the way the experts predict they will. For instance, even if you could correctly guess the outcome of every central bank meeting that still doesn’t mean the market will respond as you expect.

2. Someone is buying.

Quitting the equity market when prices are falling is like running away from a sale. When prices fall to reflect higher risk, that’s another way of saying expected returns are higher. And while the media headlines proclaim that “investors are dumping stocks”, remember someone is buying them. Those people are often the long-term investors.

3. Market timing is hard.

Recoveries can come just as quickly and just as violently as the prior correction. At the end of the GFC, the US market put in seven consecutive months of gains. That’s a reminder of the dangers for long-term investors of turning paper losses into real ones and paying for the risk without waiting around for the recovery.

4. Never forget the power of diversification.

When equity markets turn rocky, other assets like highly-rated government bonds can flourish. This limits the damage to balanced fund investors. So diversification spreads risk and can lessen the bumps in the road.

5. Markets and economies are different things.

The world economy is forever changing and new forces are replacing old ones. This applies both between and within economies. For instance, falling oil prices can be bad for the energy sector, but good for consumers. New economic forces are emerging as global measures of poverty, education and health improve.

6. Nothing lasts forever.

Just as smart investors temper their enthusiasm in booms, they keep a reserve of optimism during busts. And just as loading up on risk when prices are high can leave you exposed to a correction, dumping risk altogether when prices are low means you can miss the turn when it comes. As always in life, moderation is a good policy.

7. Discipline is rewarded.

Market volatility can be worrisome, no doubt. The feelings generated are completely understandable. But through discipline, diversification, keeping focused on progress to your goals and accepting how markets work, the ride can be more bearable. At some point, value re-emerges, risk appetites re-awaken and for those who acknowledged their emotions without acting on them, relief replaces anxiety.

A loss is not a loss until it is realised.

For those clients relying on their portfolios to deliver returns to fund living costs, we have designed these portfolios in such a way that sufficient defensive funds are available to fund lifestyles without the need to sell growth assets (equities) until the growth component of the portfolio recovers.

For those younger clients with superannuation portfolios – market declines are a blessing. They enable the purchase of investments at lower prices.

Time is the great healer of risk. Markets cannot and do not only go upwards, or downwards. There are always bumps in the road. Step back and look at the bigger picture.

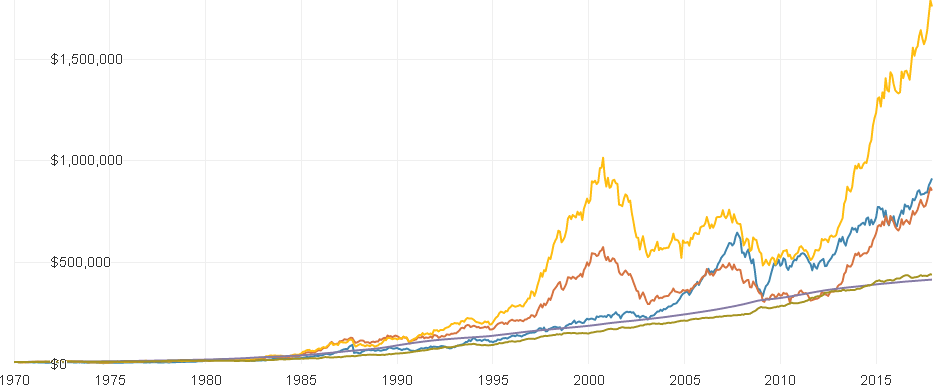

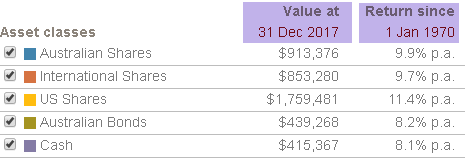

Asset Class Returns 1 January 1970 – 31 December 2017*

(Value of $10,000 invested)

*Source: Vanguard