Following our last note on the 26th of February we have continued to observe and evaluate the spread of COVID19 across the globe. We are not surprised by the wild daily swings in market indices, as the market attempts to price the economic impact of the virus and the consequent valuation of asset prices.

In an environment in which toilet rolls – manufactured entirely in Australia – are stripped irrationally from supermarket shelves, it is even more important to be aware of herd mentality. Herd mentality (also known as mob mentality) describes crowd behaviour, in which people – despite themselves – act in a manner determined by the people around them. There is always the fear that ‘they’ know something ‘we’ don’t.

Yesterday’s 7.3% decline in the Australian All Ordinary Share index, the 7.7% decline in the FTSE 100 in London, and the trading halt declared in New York – declared minutes after opening when the S&P 500 fell 7% (it subsequently finished 7.6% down for the day) – will occupy the news headlines. Indeed, in isolation, these movements are harrowing, disconcerting, unnerving.

At times like these it is imperative to ‘keep your head when all around you, others are losing theirs’.

What do we know?

- The potential for this new virus to overwhelm health systems is real. Authorities have therefore used the delaying tactic of quarantining populations in order to slow its advance.

- This is resulting in both the reduced supply of goods (inability to manufacture, service and deliver timeously), and the reduced demand for goods (loss of confidence, reduced earnings of casual workers, in particular, inability to travel).

- Economic growth will not be what was expected earlier this year. It may even decline (i.e. move into recession).

- Some companies – in particular heavily indebted companies – may fail unless supported by their government.

- Certain sectors have been disproportionately impacted – Tourism and Aviation, Textiles, Energy and Shipping.

- The virus will be managed and a vaccine will be developed. There are already trials taking place in China through a company called Gilead Sciences – refer link below.

- China is already reporting record lows in new cases, and gradually improving economic activity.

- People, countries, companies and markets will adapt.

- Markets will recover – possibly quickly.

https://www.fool.com/investing/2020/03/09/will-gilead-sciences-make-a-fortune-off-its-corona.aspx

We don’t know the timing associated with each market movement, but as long as you have adequate low-risk, liquid resources available to support you in funding your living expenses – and protecting you from becoming a forced seller, you can bide your time and wait. This level of resilience has been built into each of our clients portfolios.

We have designed our portfolios with market volatility and corrections in mind, with asset allocations in support of individual long-term objectives.

We use highly diversified low cost funds, across many asset classes – some of which are doing well in the current environment.

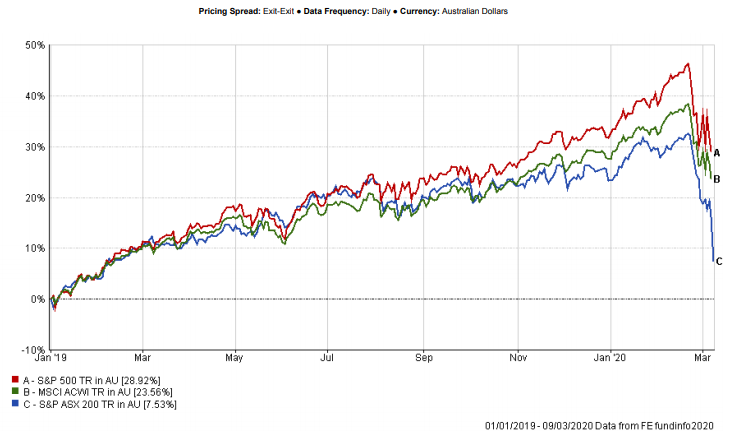

Finally, with a bit of perspective, markets remain well ahead of where they were in early January last year. Perhaps a testament to the fact that they had run too hard too fast in the first place.

Total Return (Income and Capital Growth)

1 January 2019 to 10 March 2020.