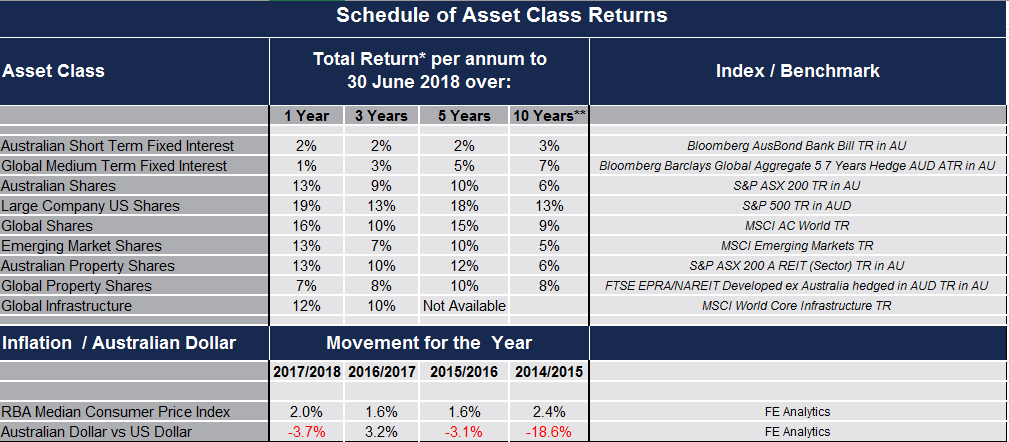

* Total Returns = Capital Growth + Income

** Incorporates the impact of the GFC

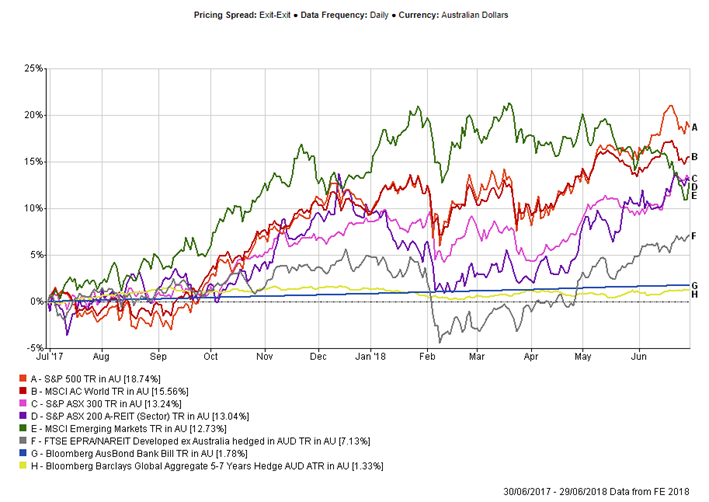

Late January, early February was a period in which markets got the sense that the growth of US wage rates was stirring, as strong job growth combined with near record low unemployment rates – suggesting a risk of inflation. As a result, US interest rates jumped – leading to a correction in all asset classes including longer duration Fixed Income. Markets then recovered as economic growth in the US, China, Europe and Asia continued on a relatively strong trajectory.

Asset Class Performance:

1 July 2017 – 30 June 2018

The outlook for equity markets is anchored to the outlook for inflation, and therefore interest rates. If US and Global interest rates continue to rise modestly, the growth in asset prices will be much more moderate than has been the case over the last few years.

An unexpected, significant jump in interest rates – of more than 1% – could lead to a market correction, with all asset classes declining – including defensives such as Fixed Interest Securities (Government and Corporate Bonds).

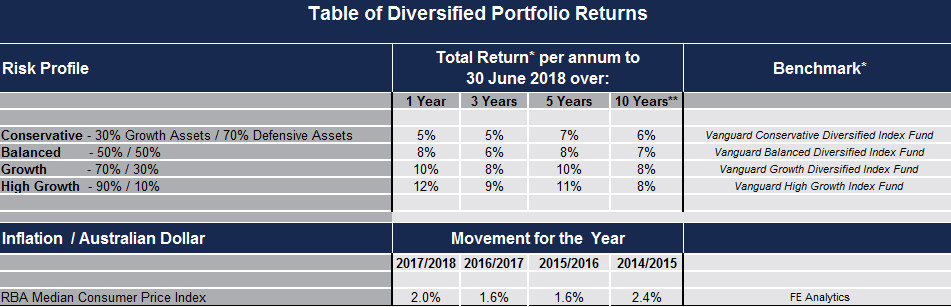

An appropriately constructed portfolio of diversified asset classes presents the investor with the highest probability of achieving their objectives at the lowest risk.

Risk is reflected in volatility. Portfolios with a higher proportion of growth assets will show greater volatility – but over time will offer higher returns. The converse applies.

*Vanguard uses a number of its own Asset Class Index Funds in constructing its diversified index funds.

The evidence from the table above shows, that for the long-term investor who is consistent in their investment strategy, there is a commensurate reward for the investment risk taken.

In this age of uncertainty and incredible change it helps to gain perspective from none other than Warren Buffet:

“Over the long term, the stock market news will be good. In the 20th century,

the United States endured two world wars and other traumatic and expensive military conflicts;

the Depression; a dozen or so recessions and financial panics; oil shocks;

a flu epidemic; and the resignation of a disgraced president.

Yet the Dow rose from 66 to 11,497″ – (now 24,174)

We look forward to continuing to support our clients in the achievement of their objectives, designing risk-adjusted portfolios and helping to “keep one’s head, when all about you are losing theirs”*.

*Rudyard Kipling